The legal doctrine of bona fide purchaser for value without notice is one of the difficult and elusive legal concept in the area of property law in many jurisdictions. It is always triggered by the fact that someone disposes of a property while he or she doesn’t have the power or right to do so, the so-called “unauthorized disposition”.

The already delicate legal issue can be further complicated when the law of unauthorized agency is brought into play in one case.

We introduce an interesting case decided by China Supreme Court in which both unauthorized agency and bona fide purchaser laws are applied.

I. Facts of the Case

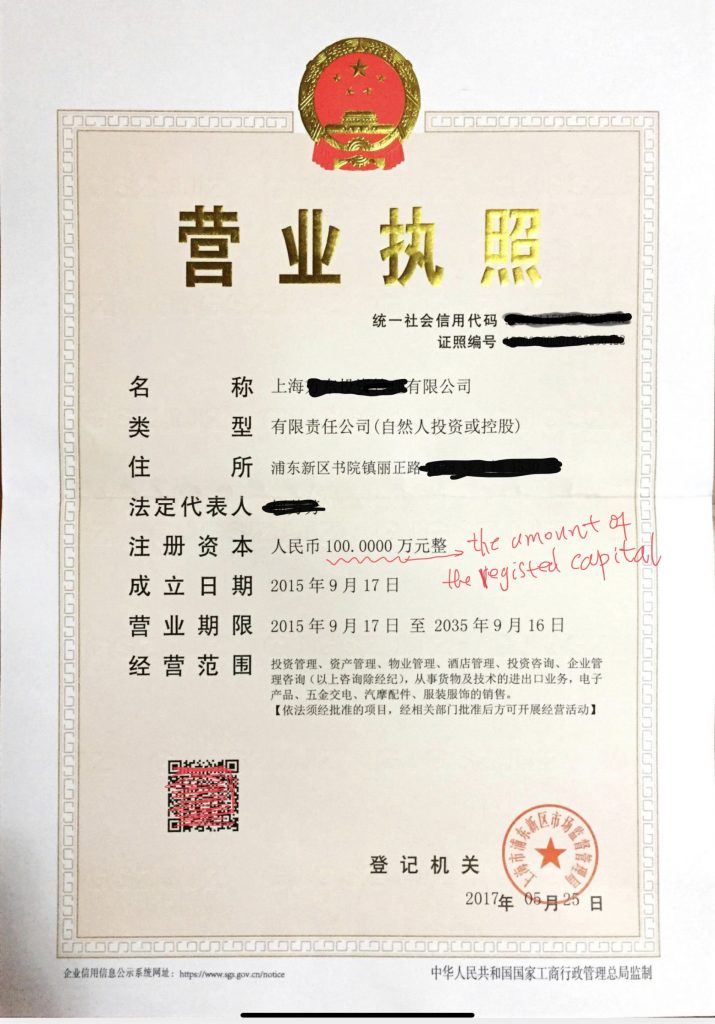

In 2009, Tom and his friend David set up a company (the “Company“) in which Tom holds 97% of the equity interests. On September 6, 2011 Tom transferred his shareholding in the Company to his father Thomson and such transfer was duly entered on the company registry. On April 3, 2013, Tom managed to transfer his father Thomson’s shareholding to David under a Share Transfer Agreement. The Company was therefore turned into a single-member company with David as the sole shareholder. Later on March 31, 2014, Tom acting on behalf of David in turn transferred all David’s shares in the Company to a third party Peter who acquired the shareholding and paid the agreed price. Company registry was accordingly updated.

So there were three share transfers in the case. It was later discovered during court hearings that:

(1) in the first share transfer between Tom and his father Thomson was genuine with no issues.

(2) in the second transfer resulting in David being the single member of the Company, Tom forged his father Thomson’s signature on the share transfer agreement. Apparently, David knew this fraud and was acting in conspiracy with Tom to transfer Thomson’s equity interests in the Company.

(3) in the third transfer from David to the third-Party Peter, Peter was not aware of any wrongdoing in the deal, and he paid fair market value for the equity interests in the Company and registered such interests in his name. Though the transfer contract was executed by Tom, the deal was later on ratified by David. It is quite clear that this David was just a puppet of Tom.

II. Legal Analysis

We will analyze each of the three transfers described above and the legal consequences under related Chinese laws such as China Contract Law, China Property Law and China Company Law.

Before diving into that, it shall be noted that under China laws, equity interests in a company or corporation are considered a special type of properties different from goods and other physical properties. China Property Law is mainly designed for and applied to physical properties with a few exceptions clearly provided therein. Equity interests are not properties governed by China Property Law. However, China Supreme Court in its third judicial interpretation of China Company Law provides that certain disputes over transfer of equity interests in a company can be decided by adopting the bona fide purchaser rule set forth in China Property Law.

All right, let us analyze the three transfers under China laws.

(1) The first transfer is a normal deal between father and son. As a result, the father Thomson acquired the legal title to the equity interests in the Company.

(2) The second transfer was fraudulently executed with both parties to that transaction being aware of the fraud. This share transfer agreement was void as a result of the violating China Contract Law which clearly nullifies any contract whose parties conspires to hard the interests of any third party.

Accordingly the annulment of the share transfer contract led to the disentitlement of David over the 97% of shareholding in the Company that was transferred there under. This further means that David was not the true owner of that block of shareholding in the Company, and he shall have no power or right to dispose of the equity interests.

The problem is that he did dispose of the shareholding soon.

(3) Here comes the third transfer where David through representation of Tom sold all the equity interests in the Company to Peter.

As mentioned in (2) above, David had no right to dispose of the 97% equity interests he illegally acquired from Thomson. But he did sell the interests to Peter.

Let us look at Tom’s representation in the deal. According to the disclosed facts, Tom entered into the share transfer agreement with Peter on behalf of David, and the fact that the shareholding was duly transferred to Peter indicated David eventually ratified the deal if Tom’s authority to act on David’s behalf was flawed at the time of conclusion of the share transfer contract. Legally speaking, there is no serious problem with regard to agency relationship between Tom and David.

Now the question arises here: is the third transfer between David and Peter legal and valid? This is where the bona fide purchaser rule kicks in.

III. Bona Fide Purchaser Rules

Bona fide purchaser rule is provided in Article of 311 of China Civil Code (to be effective from January 1, 2021). Where an unauthorized disposition takes place, a purchaser acquires the ownership of the properties (real or personal) being so disposed of when the following conditions are satisfied:

(1) the purchaser was bona fide (of good faith) at the time of purchase. But the time of purchase is, according to China Supreme Court interpretation, the time when registration of real estate and delivery of personal properties are completed.

(2) reasonable consideration is offered;

(3) the real property has been registered in the name of the purchaser or the personal property has been delivered to the purchaser.

The above general rule is designed mainly for those physical properties where actual registration and delivery are considered to embody vesting of title in those properties in the transferees/purchasers.

But in the case of equity interests in a company or corporation, the rule in respect of vesting of title is different from that described above.

It is established under China Company Law that registration with company registry of shareholding/equity interests in a company is intended to serve as defence for outsiders who rely on corporate registration in good faith. Such corporate registration doesn’t mean the vesting of title (as in the case of real properties) of the corporate equity interests in the purchaser.

Instead, title of shares or equity interests in a China company is vested at the time of conclusion of the share/equity transfer contract between the seller and buyer with a notice to the company whose shares are being transferred. Therefore, in applying bona fide purchaser rule as provided in China Property Law (or Article 311 of China Civil Code), the time of finding the good faith on the part of the purchaser is the time of concluding the sale contract instead of registration or delivery. However, this is arguable since the law is not very clear on this point.

If you are caught in a case involving a dispute over share transfer in a China company, it is always advisable to research on the local court practice regarding similar legal issues.

Comments