Understanding China’s foreign exchange rules is never an easy job, esp in an era when China is aggressively reforming its financial systems. A new rule can well be revised in a few months.

On June 9, 2016, China SAFE (State Administration of Foreign Exchange) issued its new Decree No. 16, entitled “关于改革和规范资本项目结汇管理政策的通知” (in English, Notice on the Reform and Normalization of Polices on Conversion of Capital Account Foreign Exchange), a significant step in lessening control on conversion of foreign exchange fund of capital account.

Here are the major points in summary.

I. Voluntary Conversion of Foreign Debt Proceeds

As you may just read on this blog “The Skeleton Regime of China Administration of Foreign Debts“, for a long time, foreign exchange fund raised in the form of foreign debts by Chinese entities is not allowed to be converted into RMB unfetteredly. Indeed, domestic enterprises (including banks) are not permitted to convert foreign debt proceeds at all unless approved in advance by China SAFE.

With the trial measures introduced in January this year in Shanghai Free Trade Zone in which voluntary conversion of foreign debt fund was initiated, now after just half a year, this voluntary conversion of foreign debt fund is quickly expanded to the whole country.

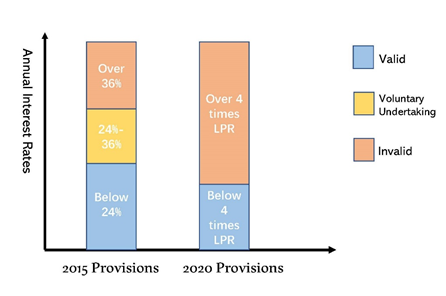

Just in March of 2015, China SAFE rolled out the trial measure of voluntary conversion of capital foreign exchange fund received by foreign invested companies (referring to the foreign exchange money contributed toward the registered capital of the said companies) in China throughout the country.

Now voluntary conversion of foreign exchange fund is now applicable to two major capital accounts.

The percentage of voluntary conversion is 100% of the foreign exchange fund under both capital accounts. In other words, the foreign exchange fund owners can choose to convert all foreign exchange into RMB in a lump sum. On the other hand, China SAFE made it clear in the Decree No. 16 that it reserves the right to adjust the ratio of voluntary conversion of capital account foreign exchange fund in light of China’s overall balance of international outflows and inflows.

Please note that this is concerning conversion of the foreign exchange funds. If conversion to RMB is not concerned, then the transfer of such foreign exchange within China and cross-border payments thereof shall still be conducted in accordance with current rules.

II To-Pay RMB Account

When the capital account foreign exchange money is converted into RMB under the voluntary conversion rule, the RMB fund shall sit in a connected new account “capital account – To-Pay RMB account” (资本项目-结汇待支付账户) through which various payments will be effected.

As a foreign exchange administration technique, China manages its foreign exchange affairs mainly through its complex foreign exchange bank accounts system.

According to Decree No. 16, the inflow into this To-Pay RMB account is the converted RMB from other capital accounts (as opposite to current accounts) such as the registered capital account, foreign exchange account for selling domestic assets, foreign exchange account for re-investment in China, foreign debt account, foreign exchange account for offshore listing, or RMB fund from other To-Pay RMB account.

The payments out of this To-Pay RMB account can be expenditures in the normal course of business operation, equity investment fund in China, RMB deposits, purchase of foreign exchange for repaying foreign debts (direct repayment of foreign debt denominated in RMB), payment of foreign exchange to foreign investors who withdraw or reduce their investment in China.

Foreign exchange purchased with the money from the To-Pay account shall not be wired into the original registered capital bank account.

III Use of Capital Account Foreign Exchange and Converted RMB

The use of capital account foreign exchange money and its converted RMB is always subject to certain limitations. For example, such foreign exchange and RMB money:

(1) shall not be directly or indirectly used for expenses outside of the company’s business scope or for expenses prohibited by state laws and regulations;

(2) unless expressly otherwise prescribed, shall not be directly or indirectly used for securities investment or other investment and wealth management products except bank-managed principal-protected products;

(3) shall not be used for giving loans to its non-affiliated enterprises, except as explicitly permitted in its business scope;

This implies that such FX and RMB money can be loaned to affiliated enterprises, a change from the Decree No. 19 issued by China SAFE in 2013 (the “[2013] Decree No. 19“, a notice regarding registration of foreign debts) whereby it is provided that except for foreign-invested leasing companies and foreign-invested small loan companies, foreign exchange money arising from foreign debts cannot be used for loaning activities.

(4) shall not be used for building, purchasing real properties that are not for self use (real estate development companies excluded).

It is worth a note that in this Decree No. 16, it indicates that RMB money in the To-Pay accounts can be used for guarantee purposes including deposit (保证金). However according to the [2013] Decree No. 19, no borrowers except security/guarantee companies shall mortgage or pledge the foreign exchange money arising from foreign debts. On the other hand, pursuant to another China SAFE rule issued in 2011 regarding RMB loans with foreign exchange as pledge, foreign exchange that can be used as pledge for RMB loans shall be limited to the foreign exchange fund under current accounts.

Comments