On January 17, 2020, China State Tax Administration (CSTA), issued an announcement regarding personal income tax on income sourced from overseas by its tax residents.

A few takeaways from the announcement.

I. China Tax Residents

As the same with definitions of other jurisdictions, a tax resident of one country doesn’t have to be the citizen of that country. It is an issue of domicile issue. A China tax resident is a person who has domicile in China, namely, that person habitually lives in China because of reasons such as its household registration (a unique system in China administering its citizens), family, economic interests.

Therefore, two groups of people shall pay special attention to this new rule:

(1) Overseas Chinese, those who are still Chinese citizens (holding Chinese passports and household registration) but habitually live in a foreign country (may have obtained a green card permanent residence). Many of them have never paid personal income tax to China CSTA and CSTA has no means to chase them in the past either. As overseas Chinese still keep their household registration in China, they are considered to have domicile in China, thus caught by China Personal Income Law to pay taxes for their overseas income.

(2) Foreigners who generally don’t have domicile in China will be considered as China tax residents if they live in China consecutively for up to 183 days. But don’t worry. China person income law has offered tax exemption to those foreigners who have not lived in China consecutively for 6 (six) years (up to 183 days for each of these six years) whereby those foreigner tax residents in China don’t have to pay China income tax on their income which is derived from sources outside of China and is paid and born by foreign entities or individuals. Instead, they will be paid income tax on their income derived from China sources or foreign-sourced income but borne by China entities.

II. How to Calculate Personal Income Tax in Regard of Domestic and Overseas Incomes

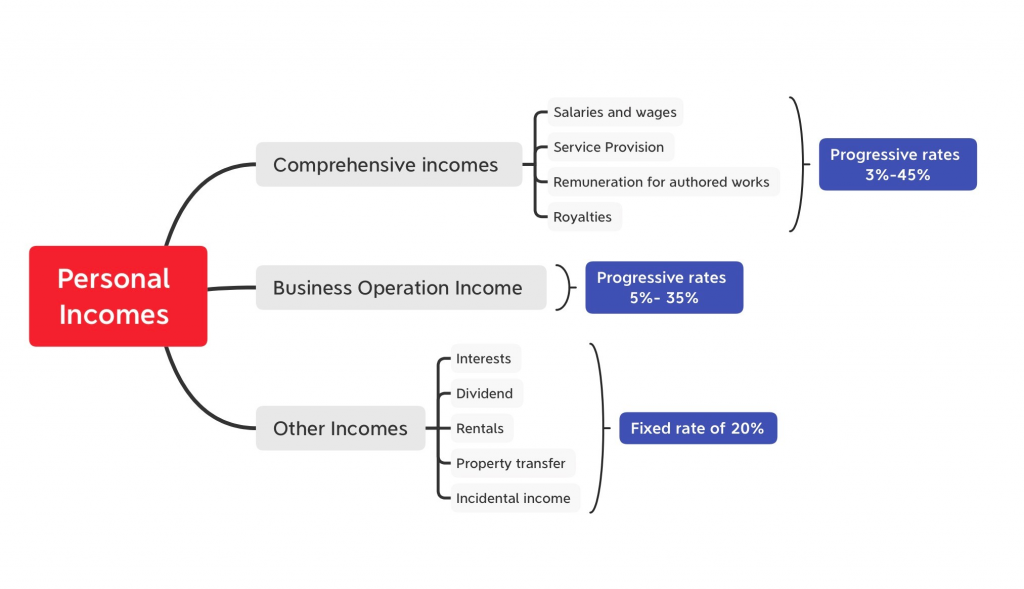

First of all, you should have an idea of classification of basic three kinds of incomes under China Personal Income Tax Law. Here you go with the following diagram.

According to the new rule:

(1) In regard of the comprehensive incomes, domestic and overseas incomes shall be aggregated and then apply the proper tax rate according to the China Personal Income Tax Law.

(2) In regard of business operation income, basic rule is to have both domestic and overseas incomes aggregated, and then apply the right tax rate. However, losses incurred in one country can only be used to set off against future income arising from the same country according to China rules, ruling out possibility of spreading the loss against incomes from different countries for the same financial period.

(3) Other incomes as described in the diagram shall be calculated separately in regard of one’s domestic and overseas incomes and shall not be aggregated.

III. Tax Credit Limits

Now when a China taxpayer claims tax credit for tax paid in a foreign country, there is now a limit on how much tax credit for that year can be allowed by China tax authority.

Tax credit limits shall be separately calculated for each of the three types of incomes. Both comprehensive and business operation incomes use the following formula:

Tax Credit Limit = tax payable as calculated under China law x overseas comprehensive/business operation income ÷ aggregate of domestic and overseas incomes

In the case of other incomes, the tax credit limit shall be the tax payable under China personal income tax law.

Such tax credit means whatever amount of actual foreign tax is paid in the foreign country, and actual tax credit that can be claimed won’t be more than the tax credit limit. The actual tax paid in foreign country in excess of the tax credit limit can be carried on into next fiscal years.

IV. Special Point of Income Sourced from within China

Generally, if a China tax resident transfers equity interests in a foreign company, income derived therefrom is an income derived from foreign source, thus is the overseas income we refer in this post.

However, if 50% or more of the value of the foreign company whose equity interests are being transferred is directly or indirectly from real properties within China at any time in the prior three years (as of the transfer), then such income is regarded as domestic income or income derived from source in China.

This is a clause that often appears in bilateral tax treaty. For example, in the tax treaty between China and Singapore, Article 13 has a paragraph as follows:

Gains derived by a resident of a Contracting State from the alienation of shares deriving more than 50 per cent of their value directly or indirectly from immovable property situated in the other Contracting State may be taxed in that other State.

It is worthy of note when clients consider asset/estate planning involving offshore companies that hold real properties or immovable properties in China.

Comments