To many, estate planning is just a part of family law practice having little involvement of corporate and investment laws. It is no longer true in today’s world when clients often have their major assets in the form of ongoing businesses, i.e., companies or corporations.

I. Why Round-Trip Investment Is Relevant

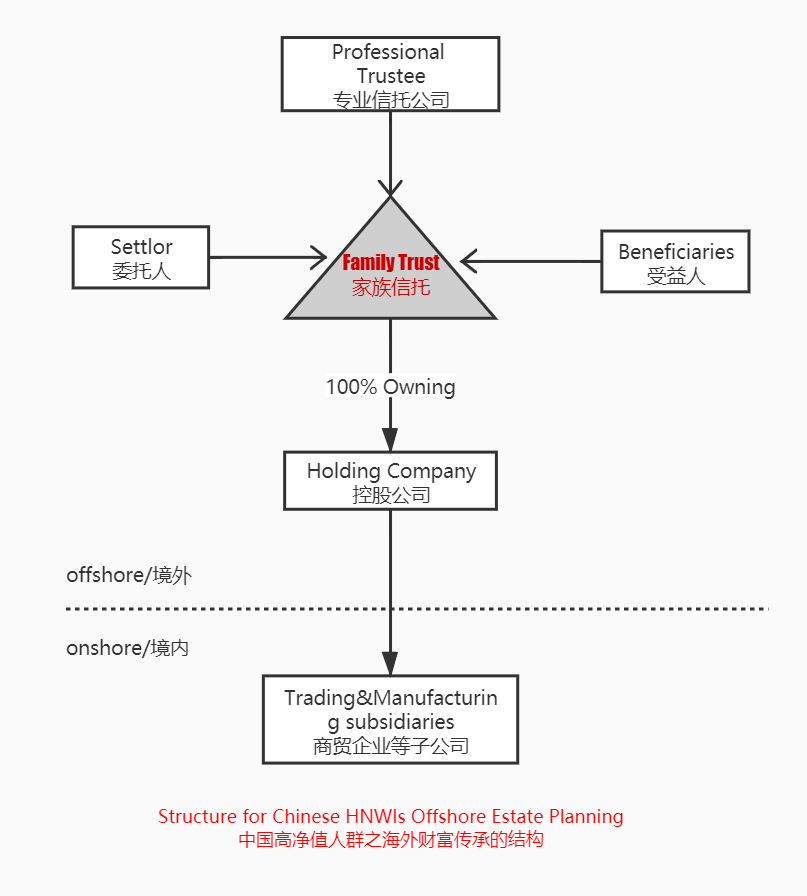

There has been growing demand among Chinese high net worth individuals for estate and succession planning set up offshore (outside China) where such Chinese HNWIs can keep operating their businesses within China. The typical structure that is designed for that purpose looks like the following:

In the structure, at the core is a family trust set up is popular offshore common law jurisdictions such as BVI, Cayman Island, Guernsey, Hong Kong or Singapore. The trust can also be replaced by a civil law foundation such as the STAK foundation popular in Netherlands.

The most difficult part of executing the plan embodied in the above figure is how to turn the onshore trading or manufacturing business entities into the subsidiaries of the offshore immediate holding company.

II. China Law Implications for Achieving the Holding Structure

Assuming Douglas, a rich China entrepreneur, has an ongoing successful business in China, a domestic company fully owned by Douglas and his family members who are all Chinese citizens, and he wishes to put in place an estate and business succession plan as depicted in the above figure.

So, the inevitable question is how Douglas can legally turn his domestic Company A into a company invested and owned by a foreign entity, and in the meantime, Douglas and his family can still control own or control the foreign entity. An easy and ready option is for Douglas to incorporate a company first, say in BVI, which is generally considered as a foreign company, and then use this BVI company to acquire the shares or equity interests in Company A. Once the acquisition is completed, Company A will become a foreign invested entity, attaining the goal set in the above figure.

Is that a viable option? What are the barriers if any?

(1) Concept of Round-Trip Investments by Chinese Residents

Round-trip investments in China refer to investments made by foreign entities (incorporated outside China) that are actually set up and controlled by Chinese citizens, also dubbed as “fake foreign investments”. Such phenomena were initially sparked by China governments offering favorable tax and policy treatments to foreign investments. Smart Chinese businessmen quickly learned to set up their own offshore company (in offshore jurisdictions like BVI, Bermuda and Cayman Island) that will come back to China as foreign investors so as to enjoy those favorable treatments available.

This trick has been widely adopted and China governments are no fools and started to scrutinize and regulate such fake foreign investments, mainly by virtue of foreign exchange control.

To appreciate the matter, one shall know that China has not allowed its citizens (for purpose of this article, Chinese citizens refer to those citizens who are also tax residents within China, excluding overseas Chinese citizens who have obtained permanent residences in foreign countries) to engaged in foreign direct investment in other countries. In other words, it is illegal for Chinese citizens to invest outside China, a prohibition aimed at preventing capital flight out of the country. I know you have known many Chinese citizens investing all over the world, but if they have not taken their domestic funds out of China or vice versa, then it is not a real concern of China governments.

On the other hand, even if Chinese citizens have already managed to set up their business entities in foreign countries and use such foreign entities to invest in China, they may have trouble when caught by China State Administration of Foreign Exchange (SAFE). They are often caught when the companies they invest in China pay big amount of dividend to the foreign parent holding company. There have been quite a few cases published by China SAFE in this regard. Typically, such cases involve Chinese citizens using their offshore entities to invest in mainland China without disclosing the controlling persons of such offshore entities, and there has even been a case in which a Chinese couple was penalized for not updating their offshore entity information after they migrated to Singapore and became real foreigners.

(2) Circular NO. 37 Issued by SAFE

A major piece of regulation of round-trip investments by Chinese citizens is the so called “Circular No. 37” issued by China SAFE on July 4, 2014. There are other related regulations I will briefly touch on later.

A few takeaways of Circular NO. 37.

(i) Definition of Special Purpose Vehicle

Circular No. 37 defined the term “Special Purpose Vehicle” (SPV) which is a foreign entity directly or indirectly established or controlled by Chinese residents (domestic resident entities and domestic resident individuals) for purpose of investments or financings, contributing their assets and interests legally owned onshore or offshore.

While it is always difficult for any Chinese individuals to use their domestic assets (those located in China) to make offshore investments (except as permitted in limited circumstances such as offshore IPO or employee stock plan in foreign companies), the regulation does for the first time acknowledge SPV set up by Chinese individuals using their offshore assets so long as such assets are legal (as a result of your work, borrowing etc.).

(ii) Foreign Exchange Registration for Outbound Investments

China SAFE’s primary concern is China’s financial security that is often affected by enormous inflow or outflow of money across border. Thus, SAFE monitors closely the activities of foreign exchange capital accounts, in particular, cross-border investments by asking banks to record any and all such activities.

According to Section 3 of the Circular, before Chinese residents (bear in mind, including Chinese entities and individuals) contribute capital to the SPV, they shall effect the foreign exchange registration for outbound investments with relevant banks. Without forex registration, funds cannot be sent out for capital contribution and future profits obtained outside the country cannot be taken into China.

(iii) Forms of Round-trip Investments

Before Circular No. 37, round-trip investments often mean the acquisition by the SPV of their own existing businesses in China owned by Chinese residents. Under this Circular, round-trip investments include greenfield investment of setting up new foreign invested company.

This new development may offer a way to circumvent the acquisition hurdle in the way when SPV comes back to China to acquire the businesses owned by Chinese residents, since acquisition of domestic enterprises by existing foreign-invested companies (real ones) is mainly regulated by other regulations other than Circular No. 10 as described below.

(iv) Disclosure of Controlling Persons for Investments in China

In practice, many Chinese businessmen have set up their offshore entities long time ago, and when they come back to China for investments, they intentionally hide the fact that foreign investing entities are controlled by them. This is where they get caught when their China companies send money out to the foreign investing entities.

Disclosure of controlling persons (something similar to the concept of ultimate beneficial owners) is now a key requirement in the course of foreign investors investing in China, a requirement by both foreign investment department and China SAFE.

(3) Regulation on Acquisition of China Businesses by Foreign Investors

Circular No. 37 is very inspirational towards achieving the desired succession planning structure shown in above figure. But the road doesn’t look that rosy.

Assuming Chinese residents have set up their SPVs, to achieve the goal of the offshore holding structure, SPV (the holding company in the Figure above) needs to come back to acquire the shares or equity interests of the domestic companies in China owned or controlled by the same Chinese residents. Here is where the insurmountable barrier lies.

Acquisition by such foreign entities of such domestic companies is explicitly addressed in the regulation regarding merger and acquisition by foreign investors of domestic enterprises, the well-known Circular No. 10 jointly issued by several ministries back in 2006, as amended in 2009. This Circular No. 10 explicitly provides in its Article 11 that such connected acquisition transactions shall be submitted to China Ministry of Commerce for approval. Ever since the inception of Circular No. 10, there has no successful precedent of such deals. This means the SPV will not be able to acquire the domestic businesses owned or controlled by those Chinese residents.

Unfortunately, the round-trip investment strategy doesn’t really work here for cross-border estate and succession planning.

III. Possible Solutions

These legal obstacles have made it virtually impossible to set up the desired structure to help Chinese HNWI businessmen with their offshore estate and succession plan.

Any possible way out of the impasse?

Identity and Residence Planning

To break the impasse, a plausible option is to get a foreign passport by way of those countries’ Citizenship by Investment programs. Indeed, these passports sale in China has been promoted relentlessly by all kinds of market players in that industry.

That would sound too good to be true.

First off, if the client or his or her family members (those intended beneficiaries) obtain foreign passports but they continue to live within China as usual, this will render them subject to Circular No. 37. This is because domestic resident individuals under Circular No. 37 include those foreign individuals who habitually reside in China due to economic relationships. In other words, even the Chinese HNWIs or their family members have foreign passports, they will still be considered domestic resident individuals under Circular No. 37 if they continue their life as usual, residing in China most of time for work and businesses.

Second, to conduct greenfield investments or acquisitions, foreign passport holders need money. But they cannot easily take their China domestic funds out of China.

So, clients don’t just need a foreign passport, they need serious identity and residence planning.

Once choosing the proper and desirable foreign passport, clients need to ensure they actually reside in the foreign passport issuing country to establish their tax resident status there. In the meantime, before purchasing foreign passports, they should retitle some China assets (for example, real estates) into their own names, so when they become foreign passport holders and tax residents, they can apply to foreign exchange authority and tax authority to legally move the sale proceeds of those assets out of China. Then they can make their way back to acquire their China family businesses legally.

All such efforts shall be carefully planned in advance and executed with caution. Apparently, the road to set up an offshore estate and succession plan is bumpy but it may well prove to be worthy in the end.

Jason, are you familiar with Haidilao’s listing in HKEX? They managed to circumvent MOFCOM article 11 requirements by having 2 of their 4 founders emigrate to Singapore.

They then restructured Haidilao to be owned by Haidilao Singapore, which was originally set up as a subsidiary of Haidilao’s Singapore operations. The emigrated founders then controleld Haidilao, and set up WFOEs in China owned by Haidilao to acquire all of Haidilao’s PRC assets. This did not trigger MOFCOM Circular 10, article 11, given that Haidilao Singapore is controlled by the two newly minted Singaporean founders, and thus not “controlled by related party domestic individuals”.

The PRC founders then created BVI companies to hold shares of Haidilao Cayman, a new company that sits ontop of the newly restructured Haidilao Singapore (which owns all PRC assets). All they had to do was register under SAFE Circular 37.

What do you think of Haidilao’s structure? Did they find a sound legal loophole or were they just lucky that they did not get into trouble for their legal interpretation?

The Haidilao story is different from most other IPO of China companies in that its founder, Mr. Zhang is said to have changed his nationality first before they applied to get listed. In other words, when Haidilao was listed, it didn’t trigger Circular 10. I have roughly looked into some information about this listing, but is not really familar with details. Indeed, in practice, it is possible to have a China domestic company transformed into a foreign owned business when the founder family has members who have obtained foreign nationalities, it takes time, but it can be done. As a result, China business will be held by offshore structure generally involving HK holding company and BVI and Cayman structures.

Thanks Jason, that makes sense.

What about if a China domestic company solely owned by a China citizen is acquired by another China citizen using the buyer’s offshore assets (legally acquired)? In this case, is the seller of the company able to receive the proceeds of sale in his offshore banking account? Since the buyer’s funds are already outside of China, I assume this would not all under the scope of Chinese capital controls and thus do not require any approvals from SAFE or MOFCOM?

While this aragment is doable in practice. However strictly speaking, Chinese citizens are not supposed to receive the sale proceeds offshore, which is a commission of evasion of foreign excange laws.

Hi Jason,

Thanks for the insightful piece. I would deeply appreciate your assistance on the following queries.

i) Do you have a source for your reporting that “Ever since the inception of Circular No. 10, there has no successful precedent of such deals. “?

ii) Do you know if its plausible for Chinese authorities grant approval for the remittance of onshore funds held by a Chinese resident to his offshore personal investment company (say in the Caymans), for the purposes of portfolio investments (i.e purchase of American listed equities)

iii) Do you know if its plausible for a Chinese resident to acquire another domestic company, but settle the sales proceeds outside of China in USD?

iv) If a Chinese resident owns a domestic company through a Hong Kong SPV, which is ultimately owned by his Caymans personal investment company – can he then sell the Hong Kong SPV and bank the proceeds of sale in his Caymans bank account legally (to be used for his portfolio investments)?

1. well, it has been closely watched by the industry and no deal of its type has ever been reported.

2. Chinese citizens as individuals are not allowed to use domestic fund to invest outside China.

3. In the past, there has been prioneering Chinese going overseas and setting up their business offshore and may have set up structure to hold onshore businesses before round-trip investments are prohibted, in this case, if he sells HK SPV through upper intermediary company, I don’t see a problem of parking the money outside China or used for offshore investments.

However such important issues shall be dealt with greater caution, and my comments are not serving as advice, thanks.

Hi Jason, excellent piece.

Circular 10 males no mention of whether the acquisition of a domestic company by a foreign investor can be settled outside of China.

Is it possible to sell my China domestic enterprise to a foreign investor and have him wire the sales proceed to my offshore bank account? If not, do you know which regulation prohibits this?

If the buyer has money outside of China to pay you, I don’t think there is any problem fo the buyer of this arrangement of settling accounts offshore. However the chinese citizen seller may have problem with China foregn excange authority, because this arrangement is an act of evading foreign exchange rules.