As a cross-border family lawyer in China, there are always clients from USA or China dealing with estates inheritance or asset transfer to United States. Very often, American tax issues are one of the core concerns. Thus, I have endeavored to take the trouble to understand American complex federal tax systems esp in regard of estate planning issues.

[It shall be noted that information about specific point of American tax law may not be accurate, and the overall framework of using Foreign Grantor Trust for Cross-border tax planning should be valid. In real practice, we will work with American tax attorneys to set up the structure for our clients.]

I. In the Case of Gifting Assets in China to American Family Members

Recently I got an inquiry from a local Chinese citizen in Shanghai. He, in his seventies, wished to transfer the bulk of his assets in China to his daughter who had migrated to USA as well as his granddaughter. The amount of assets he talked about is about USD 10 million, comprising mainly real properties in Shanghai.

He knew that there are serious tax implications if he directly donates those assets to his daughter. For example,

These questions are daunting to me before I dived into American tax laws in the context of estate and family wealth plannings.

II. Why Foreign Grantor Trust?

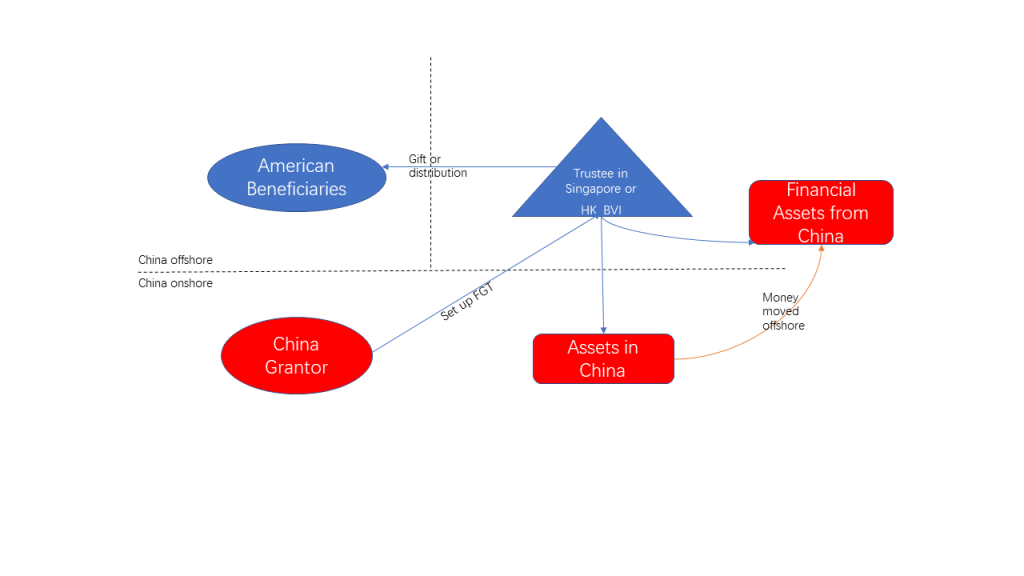

A foreign grantor trust is a term defined in American federal tax code. It is widely accepted as a sensible way for non-resident aliens to donate non-US situs assets to American beneficiaries (who are often American tax residents including US persons, green card holders and other resident aliens).

As a foreign lawyer, I don’t need to explain what a foreign grantor trust is under American laws. People can easily get some basic understanding of FGT by searching relevant information with the keyword of “foreign grantor trust” in Google. Basically, a foreign grantor trust, is (1) a foreign trust, passing the “court jurisdiction test” and “control test” under American laws, which is considered as a non-resident alien for tax purpose, and (2) a grantor trust, where the trust properties (corpus and income) are considered as owned by the grantor, not the US beneficiaries.

In brief, a foreign grantor trust, “FGT”, during the lifetime of the grantor (the settlor of the trust), won’t be taxed by IRS in terms of its incomes or capital gains, or distributions or gifts made out of the trust corpus and income despite the fact that there are American beneficiaries. The only exceptions are when the FGT holds US situs assets or otherwise has income sourced from within US, which will be subject to American taxes.

So properly structured, a foreign grantor trust can solve the tax problems facing people in the two typical scenarios described above to a good extent.

III. How FGT Works for The Chinese Father

the Chinese father could directly gift the real properties and cash to his daughter in USA. However, there are serious tax consequences of transferring properties this way in both China and USA. The tax problem in USA is particularly acute considering American income tax and capital gain tax.

As always, it is a good idea for immigrants to cash in on their assets before obtaining American green card or nationality to avoid capital gain tax. Unless the Chinese father wishes to leave properties to her daughter through a will, then it is still advisable to cash in on the China properties and gift the cash to their daughter, but by way of a foreign grantor trust.

With a foreign grantor trust settled over the cash, all the benefits of a trust are now available to the family.

V. How to Set Up Foreign Grantor Trust over China Assets

As you may know, China doesn’t really have a tradition of using trusts for family and estate planning. Further, given China’s current strict foreign exchange laws, even if a trust were set up, it wouldn’t be possible for the trusts to distribute or make gift of trust properties in large amounts to American beneficiaries.

So, we are talking about setting up the foreign grantor trust outside China and USA. In jurisdictions around China, Hong Kong and Singapore are well-known financial centers that are welcomed by Chinese high net worth individuals. More importantly, both Singapore and Hong have a long common law history, and thus good tradition and culture of using trusts for family purpose.

Esp in Singapore, they have the special rules designed just for such qualifying foreign trusts where none of settlors and beneficiaries is Singaporean citizens or residents but managed by Singaporean trustee companies. If the trust properties are invested outside Singapore, there won’t attract any income tax in Singapore which only taxes Singapore-sourced income.

Well, the biggest obstacle for Chinese people to employ the foreign grantor trust to benefit their American family members is how the Chinese grantors move their assets out of China so as to settle the same into the FGT. In this regard, please refer to another post on this blog: how to move money out of China.

Moving money out of China is still a dauntingly thorny issue, and there is no sign of China relaxing this area of rules any time soon. But in practice, a couple of options may still work well with proper handling.

Due to the sensitivity of this issue, we won’t dive into much detail here. We welcome any comments and discussion on the topic, and I will be happy to share more with you.

Comments