For many years, loaning activities were tightly controlled and regulated, only duly licensed banks are allowed to lend money to the public, and loans made between domestic enterprises are often held as invalid, and consequently, the borrowed shall return the loan principal to the lender and interests are seized by the state. With this rule in place, borrowings between enterprises or companies are very much discouraged. However, a footnote shall be made here: foreign shareholders in Sino-foreign joint venture enterprises are always allowed to extend loans to their China subsidiary companies. In other words, the loaning activities prohibited by the law mainly target enterprises incorporated in China.

With China economy having been booming for years, priviate lending between companies or enterprises has never died out at all and indeed, the undercurrent is strong esp in developed areas of China like Zhejiang, Guangzhou and Jiangsu provinces. The main reason for private lending is that non-state-owned private companies have immense difficulty to borrow money from commercial banks whose lendings are legal but very averse to small- and mid-sized private enterprises.

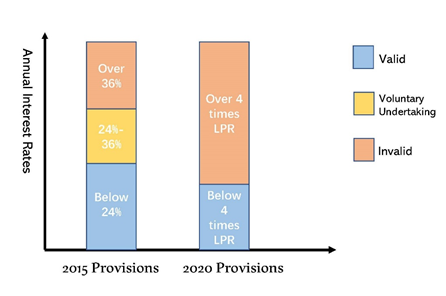

Realizing the positive complementary function of private lending to the country economy, calls have been made to the government to relax restrictions on private lending between enterprises, which resulted in the issue of new judicial interpretations from China Supreme Court on private lending in the publishing in August of 2015 with the title of “Provisions on the Application of Laws on Private Lending Cases” (hereinafter, the “Provisions”), effective as of September 1, 2015.

Article 11 of the Provisions provides:

Contracts for private lending concluded between legal persons and other forms of organizations for purpose of meeting their needs of production and business operation shall be held as valid unless such lending is in breach of the Article 52 of China Contract Law or Article 14 of the Provisions.

This is basically a reversal of mindset for perceiving loans made between businesses from general invalidation with exceptions of validity to general validation with exception of invalidity. With the effectiveness of the Provisions, companies can now legally borrow money from their peers to meet their occasional need of cash flow.

Now you wish to know what the Article 52 of China Contract Law and the Article 14 of the Provisions say. Here they are:

Article 52 of China Contract Law sets out circumstances in which a contract shall be held as void.

A contract is invalid in any of the following circumstances:

(i) One party induced conclusion of the contract through fraud or duress, thereby harming the interests of the state;

(ii) The parties colluded in bad faith, thereby harming the interests of the state, the collective or any third party;

(iii) The parties intended to conceal an illegal purpose under the guise of a legitimate transaction;

(iv) The contract harms public interests;

(v) The contract violates a mandatory provision of any law or administrative regulation

Circumstances of (i) to (iv) are relatively clear and easy to prove but item (v) is one that has led to a lot of confusion and uncertainty esp after China Supreme Court, in an effort to refrain courts from readily invalidating business contracts, interpreted that “mandatory provisions” in this Article 52 should be further divided into “validity-oriented mandatory provisions” and “administration-oriented mandatory provisions” and only violation of the former mandatory provisions will give rise to invalidation of a contract.

But the differentiating two types of mandatory provisions in practice can perplex any sober mind as very often the law gives no indication of the nature of the mandatory provisions and judges can be divided in regard of any specific mandatory provision.

Article 14 of the Provisions provides:

In any of the following circumstances, the people’s court shall nullify the private lending/borrowing contract:

(i) obtain loan proceeds from financial institutions and lend the money to borrowers for usury and the borrower knows or ought to know that beforehand;

(ii) borrow money from other enterprises or amass money from employees, and then lend such money to borrower for profits, and the borrower knows or ought to know that beforehand;

(iii) prior to making the loan, the lender knows or ought to know that the borrower is to use the loan proceeds for illegal and criminal activities;

(iv) violate the public order and good social customs;

(v) other violations of mandatory provisions in any laws or administrative regulations.

Here the core idea is clear. While the courts will respect most lending arrangements between enterprises, they will outlaw any “loan-flipping” activities that are carried out solely for profits derived from interest rate differences.

Comments