Very often we get inquiries from foreigners pertaining to purchase of China properties in the name of their Chinese girlfriend or wife for the reason that they are not qualified to purchase properties in China (China has placed restrictions on foreigners buying properties in China ever since 2006). But they are concerned about losing the property once their relationship breaks down.

That is definitely a real concern. For those guys who don’t want to lose their investment in the China property, they have to take measures to protect themselves.

But how? Not much more than a legal contract can you do to protect yourself.

So what is the take of Chinese laws and courts on such contracts? I mean in the case that the foreign guy jilts (divorces) or is jilted (divorced) by his Chinese ex-sweetheart.

I. The China Marital Property Regeme

In brief, China has adopted the community property system (those not exactly the same as the concept denotes in other jurisdictions, but similar) for a married couple (we don’t have common law marriage in China) whereby a spouse’s assets prior to marriage remains his or her own assets throughout the marriage, but assets or properties earned or acquired by way of investment interests, business operation, inheritance (generally speaking) and the like during the life of their marriage are consdiered community properties regardless whoever is registered as title holder.

In opposite to the default rule, for married couple, they can sign the nupital agreement or pre-nuptial agreement to decide on the ownership of marital properties in part or in whole. Some inquirers have asked wehther it is possible to sign nuptial agreement after marriage or it can only be signed before marriage. This is clear in China that you can sign it either before or after marriage.

In particular, China Marriage Law has made it clear that the couple can stipulate in their pre-nupitial or nuptial agreement that one’s proir assets can be agreed to be jointly owned by the couple or separately owned, in whole or in part. So it has been thought approprirate to stretch the rule to mean that one spouse’s apartment or house owned by him orher prior to marriage can be agreed to be owned by the other spouse after marriage. What is the big difference between 1% & 99% co-ownership and 100% owned by the other?

That understandindg has been changed when China Supreme Court issued an interpretation on the matter back in 2011, in which the Supreme Court prescribed that:

Where prior to marriage or during the life of marriage, the parties agree that one party gifts his or her personal real property to the other party, and the donor rescinds the gift before the change of registration of title is effected, and the other party reqeusts the court to order the real performance of the gift, the court shall deal with the case in accordance with Article 186 of China Contract Law.

Article 6 of China Supreme Court Interpretation III of China Marriage Law

With this rule comes into play, the general law regarding gift making prevails over the China Marriage Law, leaving uncertainty about validity of such a gift as stipulated in the pre-nuptial or nuptial agreement by the couple.

II. What About A Name-Borrowing Agreement

Name-borrowing purchase is the literal translation of the term (Jie Ming Mai Fang) in Chinese referring to the situation where X contributes the fund in purchasing a property but fore various reasons the property is registered in the name of Y and they agree that Y is just holding the title on behalf of and for the benefits of X, a similar arrangment as a bare trust in common law jurisdictions.

However, such name-borrowing purchase of properties is contraversial in China judicial practice where different courts deliver different decisions in cases invovling much the same facts.

There are many reasons why people borrow others’ names to purchase properties such as restriction imposed by law (for example government officials) and laundering money. For purpose of this post, we only discuss the case that foreign purchasers are restricted by government policies as part of the efforts to curb redhot real estate market.

There are two layers of contraversies surrounding name-borrowing purchase of properties.

(1) Whether the name-borrowing contract is valid. Some courts regard such contracts as valid, acknowledging the circumvention of such restrictions shall not affect the validity of the underlying transaction, but some other courts take the opposite stance. It seems the majority favors the former stance.

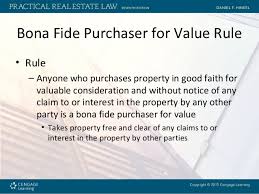

(2) given the name-borrowing contract is valid and facts are clear, the courts also divide on whether the actual buyer may sue to assert proprietary interests in the property by claiming to quiet the title or to affirm his or her title, or the actual buyer may only sue to assert contractual right against the other party by requesting the other party to transfer title to him or her.

Such difference is rather a technical freak of complicated legal theories in civil law jurisdictions, making no much sense to lawyers from common law systems, but it does matter.

My personal take is that the contract is valid, and the actual buyer should enjoy a clear proprietary interest and right in the property registered in the nominee’s name.

III. What Contract You Can Write to Protect You

From the accounts above, it is obvsious that it is not a simple and straighforward matter.

Clients may write the agrerement in different legal language and wording to achieve their respective goals of making such arrangments. For example, if the clients are ready to share the ownership with the girlfriend or wife, then structure this deal into your nuptial or pre-nuptial agreement. Otherwise, you may just want to sign a name-borrowing contract.

Comments